Biden’s student loan forgiveness plan is in danger of being struck down. What’s Plan B?

The Potential Threat to Biden’s Plan

President Joe Biden’s plan for student loan forgiveness is facing potential jeopardy as the Supreme Court prepares to rule on the legal challenge to the plan. The conservative majority on the court has signaled skepticism toward the plan, raising concerns for the more than 40 million Americans who could benefit from the debt relief. However, if the Supreme Court rejects the Biden administration’s legal case, it doesn’t necessarily mean the end for student loan relief hopes. Progressive activists and legal scholars have long argued for alternative paths to justify loan forgiveness, and advocates believe the Biden administration has options if it acts quickly and decisively.

Advocates for Loan Forgiveness

According to Astra Taylor, a co-founder of the debtors union called the Debt Collective, there are other ways to justify loan forgiveness, even in the face of an unfavorable Supreme Court ruling. Taylor states that there is a “Swiss Army knife” for canceling student debt, with different tools available depending on the circumstances. While Republicans have been adversarial, advocates believe that the Democrats and President Biden are not as powerless as they might pretend to be.

Plan B: Resting the Case on the Higher Education Act

One potential Plan B, championed by Senator Elizabeth Warren and Senate Majority Leader Chuck Schumer, involves using a broad provision of the Higher Education Act of 1965 to justify debt forgiveness. This law, known as the “compromise and settlement” authority, grants the secretary of education the power to “compromise, waive, or release” federal student debt. The idea is to argue that the authority to collect debt also implies the authority to forgive that debt. The government has already invoked this power in programs like the Public Service Loan Forgiveness program and other income-based programs.

However, the exact limits of this authority are not explicitly defined in the law, leaving it open to interpretation. Some legal scholars argue that the secretary of education has broad discretion in how to readjust or reprioritize debt collection and cancellation. This maximalist view suggests that cancellation could be justified on the grounds of avoiding defaults and unpaid debts in the long term. Another justification could be based on the fact that the Department of Education has already notified millions of borrowers of their eligibility and approved some level of debt cancellation. This change in terms could be argued as a defense against lawsuits demanding full repayment.

Differences in Implementation and Potential Challenges

If the Biden administration were to pursue this Plan B, the implementation would differ from the original plan based on the HEROES Act. Instead of relying on a specific provision of a post-9/11 era law, a plan based on the Higher Education Act could be issued either as a regulation or an “order.” A regulation would go through a negotiation process and a public comment and congressional review period, potentially facing additional legal scrutiny and challenges. An order, on the other hand, would require coordination with other executive agencies and departments but could lead to faster implementation of loan cancellation.

Additionally, the speed of implementation is a critical factor for advocates of debt cancellation. The original criticism of the Biden administration’s plan was the time lag between the announcement, application rollout, and approval of relief, providing opponents ample time to prepare legal challenges. A swifter implementation could mitigate these challenges and push the courts to decide on the legality of reimposing forgiven loans.

Analysis and Commentary

The Implications of the Supreme Court Decision

The Supreme Court’s ruling on Biden’s student loan forgiveness plan will have significant consequences for millions of Americans burdened by student debt. It represents a critical test for President Biden’s agenda and his ability to address the economic challenges faced by many young Americans. The outcome will have political ramifications as well, given the upcoming 2024 election.

Philosophical Considerations

This case also raises philosophical questions about the role of government in addressing societal issues. Advocates for loan forgiveness argue that the government has a responsibility to alleviate the financial burden on individuals who pursued higher education in pursuit of economic opportunity. They see student debt cancellation as a means of rectifying structural inequalities and expanding access to education.

On the other hand, critics argue that debt cancellation is unfair to those who have already paid off their loans or who have chosen not to pursue higher education. They question whether it is the government’s role to intervene in personal financial matters and whether debt relief programs create moral hazard by incentivizing risky borrowing.

Editorial and Advice

While the Supreme Court’s ruling is awaited, it is prudent for the Biden administration to prepare for the possibility of a rejection of their current plan. The Higher Education Act provides a potential path forward, and the administration should explore this option to ensure that relief is not entirely dependent on the Court’s decision.

Furthermore, regardless of the Court’s ruling, the issue of student loan debt remains a pressing concern. It is essential for policymakers to consider long-term solutions that address the root causes of escalating college costs and explore options for expanding access to higher education without burdening students with crippling debt. Additionally, efforts should be made to improve financial literacy and support alternative pathways to success that do not rely solely on traditional four-year degrees.

Ultimately, the fate of Biden’s student loan forgiveness plan rests not only in the hands of the Supreme Court but in the ability of lawmakers and policymakers to find equitable and sustainable solutions to the student debt crisis.

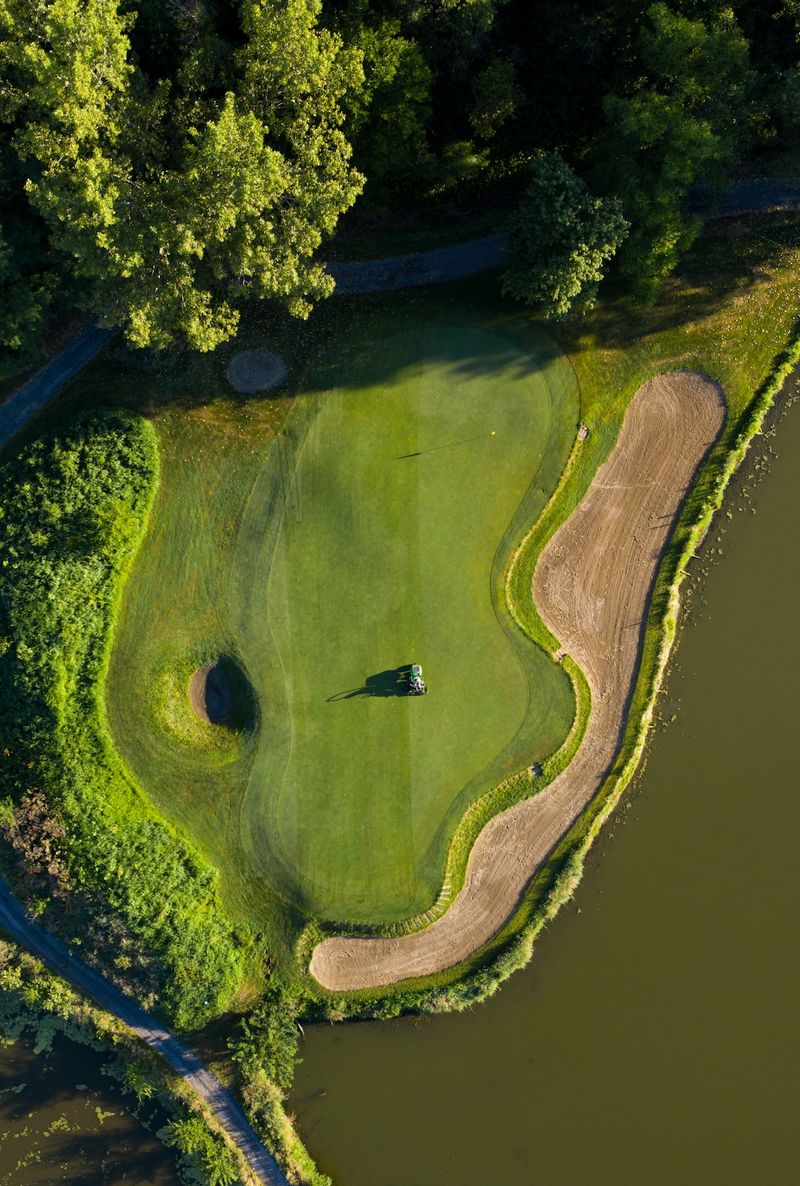

<< photo by Maria Oswalt >>

The image is for illustrative purposes only and does not depict the actual situation.

You might want to read !

- The Supreme Court’s Hidden Clue: What Does It Mean for Student Rights?

- “Supreme Court strikes down Alabama’s voting map that favored white voters”

- Supreme Court Upholds Restriction on Racial Discrimination: What Could This Mean for Affirmative Action?

- Why the Biden-McCarthy debt ceiling bill is a temporary solution to an ongoing problem

- “Analyzing the Legal and Political Implications of Donald Trump’s Not Guilty Plea for Classified Documents Charges”

- The Implications of Jack Smith’s Involvement as Special Counsel in Trump’s Ongoing Legal Battles

- EXPLORING THE IMPLICATIONS: Trump’s Indictment on Seven Criminal Counts.